Over the past years, private debt has become one of the most rapidly developing spheres of investment. Although stocks, bonds, and real estate have long reigned supreme in the financial markets, there is growing interest among investors in the area of private debt as a stable source of returns, as well as diversification of portfolios and access to unique opportunities.

The global private credit market is projected to reach approximately $2.8 trillion by 2028, up from around $1.5 trillion in 2024. But what is this thing called ‘private debt’, and why is it such a favourite among most investors? This article examines the concept of private debt, its advantages, risks, and the reasons why it remains popular among a large number of investors.

Understanding Private Debt

A Private debt is any loan or credit by non-bank lenders in the form of loans or credit to a company, organisation, or individual. In contrast to public debt, which is listed in an exchange as bonds or other securities.

This will enable the lenders and investors to design the terms of the loan to suit the particular demands of both parties. It also avails capital to borrowers, especially small and medium-sized enterprises (SMEs), which they might not easily access through traditional banking solutions.

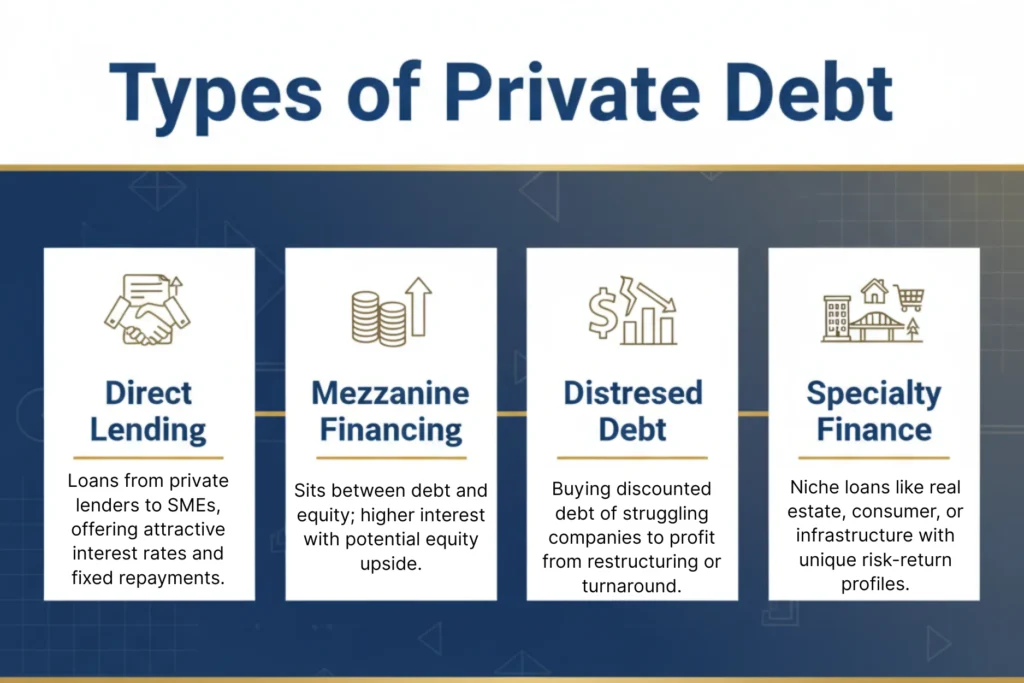

Types of Private Debt

Private debt is a broad category that includes several types of investment instruments. Some of the common forms include:

1. Direct Lending

Direct lending involves direct lenders giving loans to a company, usually a small- or medium-sized company (SME) without readily available access to conventional bank borrowing. The interest rate on these loans can be quite attractive, and repayment can be fixed.

2. Mezzanine Financing

Mezzanine debt is located between the senior debt and equity. It typically bears more interest but can be equity-linked, e.g., warrants, so that lenders gain on an upward performance by the company.

3. Distressed Debt

Distressed debt is the investment in the debt of companies that are financially challenged. This debt is sold to investors at a discount with the aim of making a profit out of restructuring, turnaround plans, or even after repayment at a later date and higher value.

4. Speciality Finance

This category covers loans that target niche markets, e.g., real estate loans, consumer loans or infrastructure projects. These investments tend to present different risk-return profiles and are not that correlated to conventional markets.

The rising popularity of private debt

There are multiple reasons why the use of private debt has become an attractive investment for investors over the past few years:

1. Attractive Returns

The conventional fixed-income securities, like government bonds and bank deposits, tend to have a low yield in a low-interest-rate setting. Conversely, the illiquidity and speciality of the investment provide higher yields in private debt. Interest payments can help investors receive steady revenue at a time when there is a possibility of upside in structured transactions.

2. Portfolio Diversification

The private debt offers the benefit of diversification, which is hard to attain in the public markets. Since it is not directly related to the performance of a stock market, it can be used as a stabilising factor in an investment portfolio. This comes in handy, especially in volatile seasons in the market when conventional assets can be underperforming.

3. Availability of Niche Opportunities

Private debt enables investors to invest in transactions that are not offered in the public markets. These can be loans to developing SMEs, infrastructure, or real estate work. Investors are able to finance such sectors and thus get an opportunity that can yield income and capital gain potential.

4. Predictable Cash Flow

Most private debt investments offer frequent interest payments, which gives them a certain predictable cash flow. This renders the private debt especially appealing to the investors interested in predictable income, including pension funds, insurance companies, and high-net-worth individuals.

5. Reduced Competition Compared to Public Markets

The number of participants in a private debt deal is usually less than what happens in the market of public equity or the bond market. This may enable the investors to bargain for better terms, like increased interest rates, collateral conditions, and covenants that safeguard their investments.

Impact of Economic Realities on Private Debt Growth

Current economic conditions, particularly rising interest rates and market volatility, are shaping the private debt landscape. Higher rates make traditional borrowing more expensive for companies, increasing demand for private debt and other debt raising as an alternative financing source.

While economic fluctuations present challenges, they also reinforce private debt’s appeal as a flexible, high-return investment option for those seeking diversification and consistent cash flow in a changing financial environment.

Suggested read: What Is Offshore Banking

How Loan Administration Differs in Private Debt Funds?

Loan administration in private debt funds differs from other investment funds due to the nature of the underlying loans. Unlike private equity, where administrators are involved in company ownership and operations, private debt focuses on structured loans, often asset-backed or collateralized.

Administrators must manage complex terms, track repayments, and monitor potential defaults or delinquencies. Properly crafted loan agreements and robust safeguards are essential.

Many fund managers outsource loan administration to streamline processes, ensure compliance, and maintain efficiency throughout the investment lifecycle. This specialized approach helps protect both investor interests and fund performance.

Risks Associated with Private Debt

Although there are numerous advantages of having private debt, it is not risk-free. These factors need to be taken into serious consideration by the investors before they commit capital:

1. Illiquidity

Investments in private debt do not change hands in the public market, and as such, they may be hard to sell fast. The investors should be ready to retain these investments to maturity or repayment of the loan by the borrower.

2. Credit Risk

When lending to businesses, particularly SMEs or banks with distressed business dealings, there is a risk of default by the borrowers. Although to some extent, covenants and collateral will help limit this risk, this cannot be done away with completely.

3. Limited Transparency

Due to the nature of deals in private debt, transparency is not always as high as in the public markets. Investors must depend on due diligence and trusted fund managers to know the risk involved.

4. Market and Economic Risks

The economic recessions, fluctuations in interest rates, and industry-specific issues may influence the solvency of borrowers, which influences the investment returns.

How Investors Access Private Debt

Investors can access private debt through several channels:

- Private Debt Funds: These funds pool capital from multiple investors to provide loans to private companies. They offer professional management and diversification across borrowers and sectors.

- Direct Lending: High-net-worth individuals or family offices may choose to lend directly to companies, often negotiating terms tailored to their preferences.

- Specialized Platforms: Fintech and alternative lending platforms are increasingly providing opportunities for smaller investors to participate in private debt deals with lower minimum investments.

By choosing the right access point, investors can balance risk, return, and liquidity according to their goals.

Future Prospect of the Private Debt

The outlook for private debt is bright. As banks are more closely regulated and have fewer funds to lend out, private debt providers are bridging a significant market gap. SMEs and other borrowers are also demanding flexible financing schemes, and the private lenders are in a good position to offer them.

In addition, the economic uncertainty experienced globally and the low interest rates are likely to keep the investor interested in the private debt as a means of high, consistent returns. With the maturing of the market, it is possible to witness advanced structures, transparency, and wider involvement of institutional and individual investors.

Conclusion

Personal debt has ceased to be a fringe product of the financial market and turned into a mainstream investment. It is popular because of appealing yields, portfolio diversification and the availability of special lending markets.

Despite the risks, with proper planning, professional management, and due diligence, private debt is an even more attractive option to investors interested in stability and growth.

With the ever-changing world markets, privacy debt will probably keep increasing; it brings a win-win situation to both the borrowers and investors. As an alternative to traditional assets, private debt is a long-term, diversified, and, above all, income-growth opportunity.