It’s normal to occasionally find oneself in need of financial aid in the fast-paced world of today. Loans can be a useful tool in managing our money, whether they are taken out for property purchases, schooling, or unforeseen costs. However, to make the best choice for your financial well-being, it’s crucial to take some time to think things through and weigh a few important criteria before jumping into a loan. In this thorough tutorial, we’ll go over the crucial considerations to make before taking out a loan.

1.) Knowing Your Needs: It’s important to know why you need the money before you even consider applying for a loan. Do you want to invest in your future, pay for unforeseen bills, make a big purchase, or restructure debt? Determining your unique demands will enable you to choose the loan kind that best fits your circumstances.

2.) Evaluating Your Financial Situation: Examine your financial situation carefully right now. Think about your earnings, outgoings, possessions, and loans. You may decide what kind of repayment terms are reasonable for you and how much you can afford to borrow by taking stock

of your financial situation.

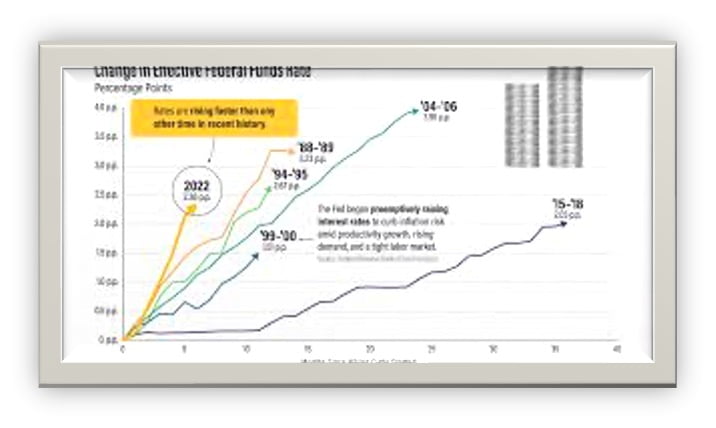

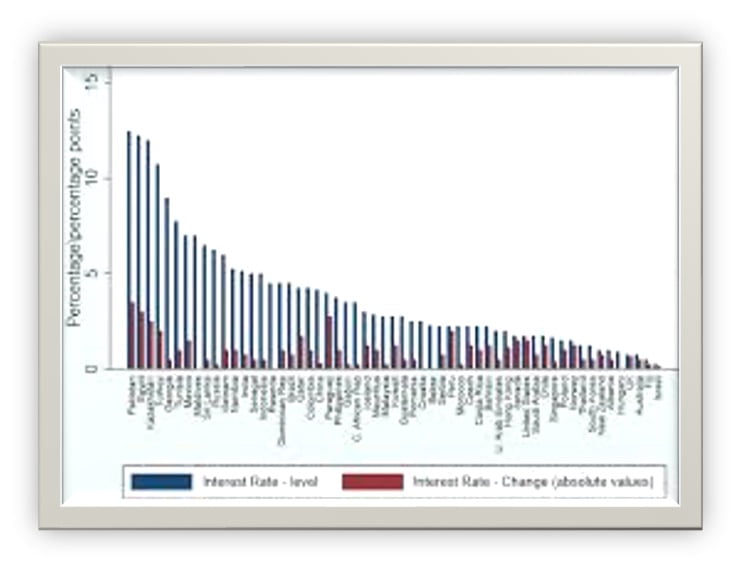

3.) Comparing Interest Rates and Fees: The entire cost of your loan can be greatly impacted by interest rates. To get the best deal, compare interest rates offered by several lenders. The total cost of borrowing can also be increased by additional costs, so be careful to account for any linked with the loan, such as origination, prepayment, or late payment fees.

4.) Comprehending Repayment Terms: Go over the loan’s repayment terms carefully, taking note of the duration, monthly payment amount, and payback schedule. Make sure you know how much and for how long you will need to pay each month. Longer loan periods usually mean smaller monthly payments, but over time, the interest may mount up.

Depending on the loan type, the lender, and the state of the market, interest rates might change in the United Arab Emirates. Certain loans might have fixed rates, but others might have variable rates that are based on benchmark indices like the Emirates Interbank Offered Rate (EIBOR). Foreign exchange rate risks may also be a factor for expats to consider when considering loans denominated in foreign currencies.

Types of Loans Available in Dubai Markets : The financial industry in Dubai provides a range of loans, each designed to satisfy a certain demand. This is an explanation:

Dubai Personal Loans : Personal loans in Dubai offer a convenient means of obtaining additional funds for a range of purposes, such as planning a dream vacation or meeting unforeseen expenses. Applying for these loans is not too difficult provided you fulfil a few simple prerequisites. Lenders, however, will thoroughly review your credit history to determine how you have managed money. This is a crucial phase in the procedure.

Dubai Business Loans :

For businesses in Dubai that wish to expand or require assistance with financial management, business loans are crucial. The terms of these loans change according on the company’s size, nature, and financial standing. Business loans, in contrast to personal loans, may be slightly more difficult. Typically, you will need to provide an extensive business plan along with comprehensive financial documents. This aids the lender in better understanding your company and determining whether to approve your loan.

Assume you are thinking about taking out a business loan in Dubai. In that scenario, it’s critical to thoroughly prepare these documents and comprehend the loan terms to make the greatest choice for your company.

Home Mortgages and Loans :

Due to Dubai’s rapid real estate market growth, home loans are becoming a popular option for purchasers. These loans come in a variety of forms, such as variable rates, where your payment is subject to fluctuation, and fixed interest rates, where it remains constant. You will need to submit a tonne of paperwork, including proof of income and details about the home you wish to purchase, to secure a loan. To make an informed choice, it’s critical to comprehend these specifics.

To understand the market even better let’s have a look at the past rates for mortgages in uae and in comparison, to personal loans Mortgage rates reflect the interest rates charged on loans secured by real estate, primarily used for purchasing homes, while personal loan rates encompass unsecured borrowing typically used for various personal expenses.

Here are a few instances of Dubai’s current mortgage rates:

Emirates NBD: 2.99% on a mortgage with a two-year fixed rateHSBC: 4.99% for a mortgage with a 3-month EIBOR variable rateChartered Standard: A 3-year fixed-rate mortgage would cost 4.24%.

Interest rate on personal loans for foreigners Banks impose interest on the amount issued in exchange for providing personal loans for foreigners in the United Arab Emirates. Expats who take out personal loans in the UAE are charged interest in two ways:

Flat Interest Rate: For the duration of the foreigner’s personal loan in the United Arab Emirates, this kind of interest is applied to the principal amount and doesn’t change. This varies from 3.03% to 7.71%.

Interest Rate Reduction: When a borrower pays off their personal loan for foreigners living in the United Arab Emirates, the interest rate is lowered. This varies from 5.50% to 14%.